History

Most credit unions are the result of an unfulfilled need for service. Suspicion and distrust also entered the initial picture that eventually evolved into our JACom Credit Union.

Our story goes back to 1941. The attack on Pearl Harbor turned public opinion against all Japanese living in the United States, even against the Nisei (American-born Japanese). Within just a few months after the outbreak of war, President Roosevelt's Executive Order #9066, dated February 19, 1942, moved all Japanese from the Pacific Coast to one of ten hastily built relocation camps in the inland states.

When they were finally released from the camps in 1945, anti-Japanese sentiment was still strong. Homeless in their own country, they were broke and without a source of credit. The housing shortage in Southern California was very severe in post-war Los Angeles. Housing and job discrimination were pervasive. It was almost impossible to rent living quarters, and few had enough money to buy a home.

In 1945, among those who were temporarily housed at the Centenary Methodist Church, a group banded together and started a Tanomoshi Club, which was a neighborhood aid program based on mutual trust and compassion for the welfare of the group. Each Tanomoshi Club member contributed an equal share into a monthly "pot" at its monthly meetings; any member in need of a financial loan would make a bid for the month's pot.

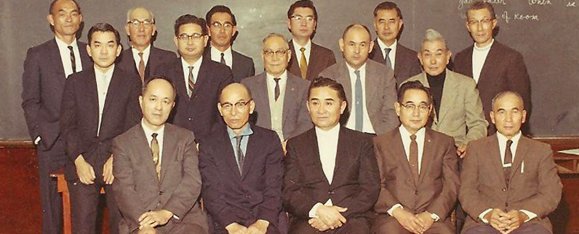

An initial group of 11 people (Morio Hayashida, Fukunosuke Kusumi, Motoki Murakami, Kiyoshi Momii, Tarojiro Nishimoto, Maoji Nitta, Shichiro Oba, Kotaro Sakakura, Justus Sato, Fusachika Satogami, and Yonetaro Shigemi) started a Tanomoshi Club and made a pledge to help each other to purchase homes of their own. The group quickly grew to 30 people. The Tanomoshi Club met at the home of Kiyoshi Momii on 37th Street, and later the group moved to the garage of Fukunosuke Kusumi on 7th Avenue. By 1950, only six had not owned their own property.

Gaining strength in both members and assets, it was deemed advisable to incorporate as a California Credit Union. In June 1951, the charter was received, and the L.A. Southwest Japanese Credit Union was born. Fukunosuke Kusumi's garage became the initial office of the credit union. With about 45 members, its goal was, as it still is today, to serve the financial needs of our ever-growing membership. By the end of the calendar year, the credit union's assets had grown to approximately $64,000 with 235 members.

The results of the credit union’s first state audit conducted by the Department of Corporations were not good. Finding fault after fault, the state auditor, in a letter dated September 9, 1952, advised that the credit union should not engage in any further business. Rather than giving up, our dedicated founders worked hard to rectify all of the problems, and on October 07, 1952, the credit union received word from the state agency that the restrictions to engage in business had been removed.

With the number of members quickly growing, it was decided in May 1954 that the credit union would rent a room at $50 a month above Kay's Hardware Store, which was then under construction. In September of that year, the credit union moved into room #2 at 3324 West Jefferson Boulevard, which it shared with the L.A. Southwest Gardeners Association.

By the end of 1955, the credit union had reached its 1,000th member with assets of almost $400,000. The 1,000th new member, Mrs. Haruko Shima, was honored with a commemorative gift.

JACom Credit Union continues to grow and evolve with the focus set on serving the financial needs of our membership. Highlighting moments include...

Credit Union Timeline

August 1957 – The CU moves to 3060 11th Ave.

February 04, 1958 – The one-time membership fee is raised from 50¢ to $2.00.

1960 – An aggressive promotion year brought 478 new members, twice the growth rate of any previous year.

1961 – The CU’s 10th Anniversary. Kotaro Sakakura, who had been President for the past 10 years, retires.

July 1962 – The CU reaches its 1 million mark in assets and 3,888 members strong.

September 1964 – The CU moves to 3037 W Jefferson Blvd.

February 11, 1965 – Shigeru Yamashita becomes the CU’s 5,000th member.

October 1967 – The Service Bureau Corporation’s online computer system is obtained. Passbooks are eliminated and replaced by quarterly statements.

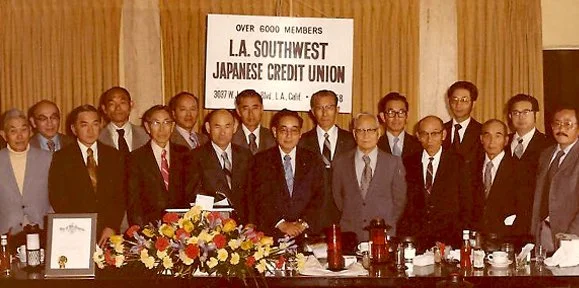

1971 – The CU’s 20th Anniversary. Assets grow to nearly three million dollars, and membership reaches 6,000 strong.

April 1977 – The CU begins selling traveler’s checks.

December 5, 1977 – The Board of Directors increases the minimum share balance from $5 to $25.

July 1978 – The CU begins to sell money orders.

April 1980 – A share draft (checking) program is started.

April 1983 – An IRA plan is adopted.

May 1985 – The new office building built behind the current building is complete. Soon after, the now-old building is demolished to provide space for a parking lot.

March 1987 – ATM cards to access funds in the share draft account through Security Pacific National Bank (SPNB) ATM network become available.

January 1989 – Direct Deposit becomes available.

May 01, 1989 – The Board of Directors increases the membership fee from $2 to $5.

July 1990 – The CU begins utilizing Ultra Data’s in-house computer system.

August 1990 – ARS (audio response system) now allows members to access their accounts 24/7 via phone.

September 1990 – Approval is received from the Department of Corporations (DOC) to expand our membership boundaries to include all of Los Angeles County and also include all immediate family members (i.e., parents, children, spouses, and siblings) of existing members into our field of membership.

August 1991 – The Japanese School Credit Union and approximately 350 members merged into our CU.

September 1992 – Home loans, which were the basis for establishing the CU and had been discontinued for years, are reintroduced.

October 1992 – Bank of America, which had bought out SPNB, terminated the share draft and ATM program credit unions had with SPNB. Wescorp becomes the share draft processor, and the CO-OP Network becomes the ATM processor for the CU.

May 1993 – Home equity loans become available.

September 1995 – The “Ri” Visa Credit Card becomes available.

March 1997 – The DOC approves our field of membership change to include all those of Japanese descent residing in Orange, Riverside, and San Bernardino counties.

September 1997 – Share Certificates become available.

November 1997 – The CU gets a toll-free phone number (888) LASWJCU or (888) 527-9528.

October 1998 – Y2K preparations begin.

January 1, 2000 – Y2K arrives with no hoopla. The CU is ready. All accounts are fine. No data is lost.

April 23, 2001 – The CU celebrates its 50th Anniversary. Assets reach 54 million, and membership is over 8,800. 25 members who had opened their accounts back in 1951 continue to be steadfast loyal members.

May 20, 2001 – A 50th Anniversary Luncheon is held at Quiet Cannon Restaurant. Over 220 members attended the celebration.

June 2001 – The CU changes its name to JACom Credit Union. JACom is an acronym for Japanese American Community. The name was chosen to more accurately represent our ever-growing field of membership.

July 2001 – The CU gets a website. www.jacomcu.org.

August 2001 – Members can now check their “Ri” Visa Credit Card information online at www.ezcardinfo.com.

November 2001 – Harbor Japanese Credit Union merges with JACom CU. Until the computer systems can be integrated, the Harbor JCU accounts continue to be serviced separately.

December 2001 – ATMs go online, allowing members to see real-time balances at the ATM.

April 2002 – Torrance branch opens at 2355 Crenshaw Blvd, Ste 146, Torrance, CA 90501.

May 2002 – The Harbor JCU/JACom CU merger is complete. The former Harbor Japanese Credit Union office at 1766 Seabright Ave, Long Beach, CA 90813, becomes our Long Beach branch. Members can now transact their CU business at all three locations.

May 2002 – Citicorp discontinues its traveler’s check program. The CU begins offering American Express Traveler’s Cheques and Cheques for Two.

February 2003 – Cashier’s checks become available.

June 2003 – Picture ID cards are introduced along with the Kaeru Network – a program in which members receive special discounts at select establishments by showing their JACom CU ID cards.

September 2004 – The “Okane” Visa Debit Card becomes available.

March 2005 – The Education Resource Center powered by College PayWay becomes accessible via our website at www.jacomcu.org. The resource center provides SAT diagnostic testing, searching for scholarships, and more.

July 2005 – The CU sponsors the 65th Nisei Week Baby Pageant.

September 2005 – The CU now offers American Express Traveler’s Cheque Cards and Gift Cards.

March 2006 – The CU joins “Member Select” to offer members CIGNA Dental PPO & HMO coverage along with Vision Service Plan for both employed and retired CU members who do not have access to employer group plans.

February 2008 – The CU changes data processors to Integrasys’ service bureau.

February 2008 – ARS gets a new toll-free number. (800) 750-3792.

March 2008 – The Torrance branch moves to 21557 S Western Ave, Unit C, Torrance, CA 90501.

March 2008 – The CU gets NetCU – our online banking system. Members can now conduct many CU transactions from their own computers 24/7 via the Internet.

March 2009 – Auto & personal loans can now be applied for online via our website.

July 2009 – Due to rising operating costs, a new fee schedule is introduced.

November 2009 – The CU gets a Facebook page.

February 2010 – MyMoney is introduced. Members can now access their accounts while they are in their Facebook accounts.

March 2010 – The CU website gets a makeover.

March 2010 – e-Tickets become available via NetCU.

July 2010 – The CU joins LoveMyCreditUnion.org to offer discounts.

September 2010 – Mobile banking goes live with TouchBanking.

December 2011 – Special emergency/wind-storm loan made available to members in need.

February 2012 – Share draft conversion to Bank of the West.

March 2012 – The CU partners with CU Partners for mortgage products.

September 2012 – Secured credit cards become available.

June 2013 – Motorcycle loans become available.

November 2013 – The Long Beach branch closes.

March 2014 – The CU joins the CO-OP Shared Branch Network.

September 2014 – The CU partners with New Leaf Lending for mortgage products.

December 2014 – Affordable insurance plans become available from TruStage.

January 2015 – The Torrance branch changes hours to correspond with LA: Mon – Thur 9 to 5 and Fri 10 to 6.

March 2016 – Bill pay becomes available.

September 2017 – The Torrance branch closes.

March 2018 – CarFax reports become available at a discounted rate.

February 2019 – EMV credit cards go live.

July 2020 – Business hours are changed to Mon – Thu 9:00 to 4:30 and Fri 10:00 to 5:30.

November 2020 – New color and easier-to-read statements along with e-Statements become available.

December 2020 – Both the Okane debit and Ri Credit Cards can now be added to digital wallets (Apple Pay®, Samsung Pay®, and Google Pay™).

January 2021 – Due to the pandemic, the CU has its first virtual annual meeting.

January 2021 – A new and improved NetCU goes live. As part of the upgrade, Zelle® becomes available too.

September 2021 – Auto Junction, a cross between an auto loan and a lease, becomes available.

December 2021 – The mobile office is introduced.

January 2022 – Due to the continuing pandemic, the annual meeting was again virtual.

July 2022 – Sallie Mae/Student Loans become available.

September 2022 – Credit Sense, powered by SavvyMoney®, becomes available.

November 2022 – Gift, travel, and everyday spend Visa cards become available for purchase.

January 2023 – With the pandemic diminishing but still around, the CU holds its first hybrid annual meeting.

June 2023 – The website gets a revamp and becomes ADA-compliant.

May 2024 – Message Pay becomes available.

July 2024 – ATM cards get a new look.

August 2024 – Transfer Now (online funds transfer service lets member move money to/from other financial institutions to their JACom accounts).

August 2024 – Originate (open accounts online).

September 2024 – Savings rates become tiered.

January 2025 – Online banking switches from Touch Banking to our custom NetCU app.

January 2025 – For the first time since 2021 the annual meeting goes back to in person only.

May 2025 - IDCheck is implemented to proactively detect and prevent fraud in Shared Branch transactions through smart device authentication.